Breaking New Ground on Fair Housing?

At a moment of promise and peril, IPR experts offer insights to key policy prescriptions

Get all our news

Local zoning policies and ordinances are one of the contributors to the lack of affordable housing in many communities.”

Chloe Thurston

IPR political scientist

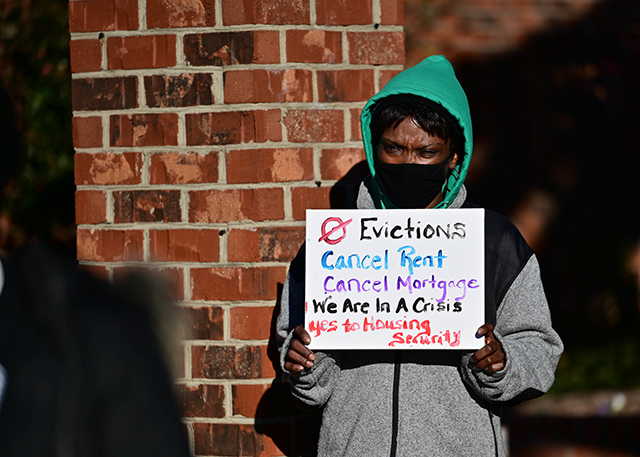

Protestors gather in Graham, North Carolina, in January 2021 to protest evictions and call for housing security.

Is America heading out of a pandemic lockdown into a housing lockout?

On one side of the fence, millions of Americans risk being thrown out of their homes on July 31 when the CDC’s eviction and federal foreclosure bans are set to expire while affordable housing inequities continue to grow. On the other, plans to break new ground on the issue have emerged: Nationally, President Biden has made affordable housing a key part of his $1.7 trillion infrastructure plan, and states and municipalities have initiated others, like the city of Evanston’s (Ill.) housing-centered reparations program.

For more than 50 years, IPR researchers have conducted seminal research on housing issues. Their studies have investigated the long-term outcomes of public housing residents, the lack of affordable housing, the effects of mobility programs, as well as persistent structural inequities like redlining, segregation, and discrimination—all exacerbated by the pandemic.

Below, five of IPR’s interdisciplinary housing experts offered their research-based policy ideas to improve affordability and reduce discrimination and segregation.

- Conduct Regular Audits and Enforce Rules to Achieve Fairer Housing

- Change Local Zoning Policies to Create More Affordable Homes

- Address Stigmatizing Disinvestments and Improve the Existing Housing Stock

- Design Mobility Programs for Pathways to Homeownership

- Enable Moves to Better Neighborhoods to Improve Mental and Physical Health

Conduct Regular Audits and Enforce Rules to Achieve Fairer Housing

IPR sociologist Lincoln Quillian, who studies discrimination and segregation in housing, views ongoing discrimination in the housing market and its effects on housing prices as contributing to neighborhood segregation and as obstacles to home ownership.

As he demonstrates in his research that examined 35 studies undertaken from 1976–2016, the most overt forms of discrimination against Black and Latino house-seekers have subsided, but more subtle forms of unequal treatment have persisted over the last 40 years. Housing audits—tests of how potential renters or buyers are treated—reveal that Black and Latino auditors are treated quite differently from White ones.

“People aren’t aware of most of the unequal treatment,” he said. “There’s no way they can know without the comparison.”

Although people who believe they have been discriminated against can file complaints, little affordable legal help is available, he notes. He would like to see the Department of Housing and Urban Development (HUD) conduct regular audits in housing markets more often than they do now to put some pressure on the behavior of real estate agents and lenders.

“If it was something they did in an ongoing way, it would be more of an enforcement activity,” he said.

Quillian also credits the Biden administration for reinstating some fair housing rules that were frozen or eliminated under Trump, such as one that requires communities receiving HUD funds to consider patterns of segregation. He would like to see more consequences for communities spending HUD funds in ways that are inconsistent with reducing segregation.

Quillian notes that one change that HUD could make without tremendous cost would be to better regulate higher-cost lenders that heavily market products in non-White communities, leading to more expensive mortgages. New requirements that lenders report more information about loan applications including credit data are just now starting to produce data that could be used to better identify lenders who may be engaging in discriminatory practices.

“That data could potentially be used to put some kind of pressure on the mortgage operations that are almost exclusively making loans in White communities to make more of their loans in Black or Latino communities than they currently are, and I think that would be a very sensible step,” he said.

Change Local Zoning Policies to Create More Affordable Homes

While blatant housing discrimination is less likely today, the pandemic has highlighted issues with affordability, including increasing rates of evictions and the way crowded housing situations helped spread COVID-19, said IPR political scientist Chloe Thurston.

While blatant housing discrimination is less likely today, the pandemic has highlighted issues with affordability, including increasing rates of evictions and the way crowded housing situations helped spread COVID-19, said IPR political scientist Chloe Thurston.

Thurston has written At the Boundaries of Homeownership, which shows how Black Americans and women were systematically denied home ownership and how groups like the NAACP and NOW mobilized to end discriminatory practices.

Thurston points to Los Angeles as one city that has struggled to control the virus because of overcrowding.

“One of the reasons that their cases went so high, so quickly was the affordability crisis in the region,” Thurston said. “Many families were living in more crowded settings and in work situations where they couldn't really protect themselves from COVID-19.”

She said President Biden’s proposal to tie federal funding to cities who ease restrictions on zoning is an intriguing policy that could help increase affordable housing and address historic exclusions.

“Local zoning policies and ordinances are one of the contributors to the lack of affordable housing in many communities,” Thurston said. They limit multifamily housing units, making these communities unaffordable.

One promising local policy that is working to address historic housing disparities is Evanston, Illinois’ recently established reparations program, funded by marijuana tax revenue. It will ultimately give $10 million to eligible Black residents, or up to $25,000 per applicant, to purchase, pay for, or repair a home in the city. Applicants have to prove that either they or their family lived in Evanston between 1919 and 1969 or they experienced housing discrimination due to the city’s actions.

Thurston says while some controversies surround the program because the funding is not that high and the program restricts how participants can use it, “it’s a really interesting idea” that is rooted in historic policy exclusions.

She also points out that enforcement of the Fair Housing Act of 1968 could help, noting that the law is scaled back or ramped up based on who controls the White House. Biden’s administration plans to bring back a requirement for municipalities to consider the racial impact of developments or policy changes.

“It’s a question of how they [the administration] choose to enforce those laws or whether they choose to enforce them,” Thurston said.

Address Stigmatizing Disinvestments and Improve the Existing Housing Stock

Sociologist and African American studies researcher and IPR associate Mary Pattillo sees some promising initiatives in President Biden's proposal, including rehabilitating homes and addressing public housing capital needs, but she also sees other critical areas to address.

“We often talk about new affordable housing construction, which is important, but just attending to the housing that exists and not letting it fall into disrepair is an important part of this plan,” she said.

Pattillo, who has written about the role of housing policy in her groundbreaking study of Black middle-class neighborhoods in Black Picket Fences and investigated public housing and gentrification in Chicago, would like to see policies that address disinvestments in historically neglected neighborhoods, such as those in largely Black neighborhoods.

“Racial residential segregation concentrates poverty in majority Black neighborhoods, and that concentration of poverty leads to fewer investments, less political clout, greater investment needs in public institutions, and so on,” she said.

Investing in Black neighborhoods is also important for improving homeownership for Black people, Pattillo says. She points out that the racial gap between White and Black people is wider than it was in the 1960s.

“The home value gap means that homeownership for Black folks is not the lucrative wealth-building exercise that it is for White people,” she said.

However, policymakers cannot address homeownership without first addressing the racism in the housing market. Pattillo said one example of racism in the housing market is the under-appraisal of Black houses in Black neighborhoods, she says. If the surrounding neighborhood lacks investment, such as functioning streetlights, good schools, or a nearby park, appraisers may not value Black homes as high as they should be. The homes and neighborhoods will be “less desirable,” she said.

“If you stigmatize Black neighborhoods, then you participate in their disinvestment,” she said. “Many of the investments in Biden's plan are important; investing in the surroundings of Black neighborhoods is just as important.”

As for local policies, she said Evanston's housing reparations initiative is a “good place to start” and believes it will help the Black middle class, which has been "disproportionately downwardly mobile."

For many Americans, renting or paying for a home outstrips their wages, making it difficult for them to build generational wealth. Pattillo's research looks at those who are hurt by a “housing cost-burden,” meaning over 30% of their income goes to rent. In 2010, 53% of renter households and 38% of homeowners were considered housing-cost burdened. In 2019, 46% of those renting experienced this cost burden, with Latino (52%) and Black (54%) renters experiencing higher rates than White (42%) renters.

For many Americans, renting or paying for a home outstrips their wages, making it difficult for them to build generational wealth. Pattillo's research looks at those who are hurt by a “housing cost-burden,” meaning over 30% of their income goes to rent. In 2010, 53% of renter households and 38% of homeowners were considered housing-cost burdened. In 2019, 46% of those renting experienced this cost burden, with Latino (52%) and Black (54%) renters experiencing higher rates than White (42%) renters.

She attributes severe housing cost burden, foreclosure, eviction, and homelessness as outcomes of treating housing as a commodity rather than a basic right.

“There's no question that homeownership in the U.S. is important, especially as the key mechanism for wealth building,” Pattillo said. “We think about housing as a commodity, and we want everybody to have private property, but that system is not working for really almost half the population.”

Design Mobility Programs for Pathways to Homeownership

Part of President Biden’s plan calls for building and rehabilitating more than 500,00 homes for low- and middle-income people in underserved communities and “creating a pathway for more families to buy a home and start building wealth.” IPR education researcher James Rosenbaum suggests mobility programs as one approach that may help advance housing initiatives, especially if it includes effective housing counselors to guide housing choices.

Rosenbaum’s research on the Gautreaux project, which examines the outcomes of a mobility program that moved mostly single mothers and their children from high-poverty neighborhoods to affluent suburbs, shows that the Housing Choice Voucher Program can increase racial and economic integration.

The results also suggest that the move led to children enrolling in much better schools and stronger education outcomes.

Rosenbaum underscores the role that effective housing counselors had in the program’s success and the location of their new homes. With the help of housing counselors, most families in the Gautreaux program moved over 10 miles, to areas with good schools and far from the influences of housing projects.

In contrast, his research on the Moving to Opportunity (MTO) program, which also used housing vouchers, found mixed results. Weak counseling led to shorter moves (less than 10 miles), and children were still interacting with their friends from housing projects, he said.

Efforts to expand affordable housing in high-poverty areas are likely to suffer the same problems, he added. In Chicago, Mayor Lori Lightfoot wants developers to allocate 20% of their units as affordable housing, up from the current 10%. However, Chicago’s Department of Housing’s Racial Equity Impact Assessment reported that most new construction developments with low-income housing tax credits (LIHTC) units remained in high-poverty areas between 2000 and 2020.

“Apartments in the same location will have the same inferior labor markets, the same violence, the same poor schools, and the same segregation,” he said.

Enable Moves to Better Neighborhoods to Improve Mental and Physical Health

IPR anthropologist Thomas McDade offers that policymakers should pay critical attention to the composition of neighborhoods where poor families move if they want to help improve their long-term prospects.

McDade was part of a research team that studied more than 4,600 disadvantaged families in five U.S. cities, who enrolled in MTO between 1995 and 1998. Two-thirds of the families were Black, one-third Latino. They made less than $12,750 per year on average, with 75% on welfare.

Published in the New England Journal of Medicine, their findings showed improved health outcomes for families who, through MTO, moved to less distressed and impoverished neighborhoods. Other study co-authors included IPR psychobiologist Emma Adam, economist and IPR associate Greg Duncan, and University of Chicago economist Jens Ludwig.

One of the advantages of following MTO families was that HUD designed the program as a randomized mobility experiment, the gold-standard equivalent of a clinical trial in medicine, allowing an apples-to-apples comparison of participating families.

Families were randomly assigned to either a control group that did not move, or to one of two voucher groups that required moves to lower poverty neighborhoods. One voucher required a move to a neighborhood with a poverty rate of less than 10%. In all, 47% of those offered a low-poverty voucher and 63% of those offered a traditional voucher relocated through MTO.

The researchers followed the MTO families for 10–15 years after the initial moves. For those who moved to lowest-poverty neighborhoods, the adult heads of families experienced better mental and physical health. Adult participants were one-third less likely to be extremely obese and had reduced their risk of diabetes by 40%. The female heads of household who moved under either voucher plan reduced their risk of major depression by 25%.

“It was disappointing that we did not confirm earlier findings of better job and education outcomes for the families who moved out of very distressed neighborhoods as previous studies had,” McDade said. “But the improvements we saw to mental and physical health were striking—and equal to the declines seen when using leading medical treatments, like insulin and anti-depressants, to treat diabetes or depression.”

McDade hopes to uncover more about how housing might affect a person’s health as part of an ongoing research project with Johns Hopkins’ Sandra Newman.

Lincoln Quillian is professor of sociology and an IPR fellow. Chloe Thurston is assistant professor of political science and an IPR fellow. Mary Pattillo is the Harold Washington Professor of Sociology and African American Studies and an IPR associate. James Rosenbaum is professor of education and social policy, and of sociology, and an IPR fellow. Thomas McDade is the Carlos Montezuma Professor of Anthropology, director of Cells to Society (C2S): The Center on Social Disparities and Health, and an IPR fellow.

Photo credit: Flickr; A. Crider and D. O'Neil

Updated: June 30, 2021

Published: May 28, 2021.