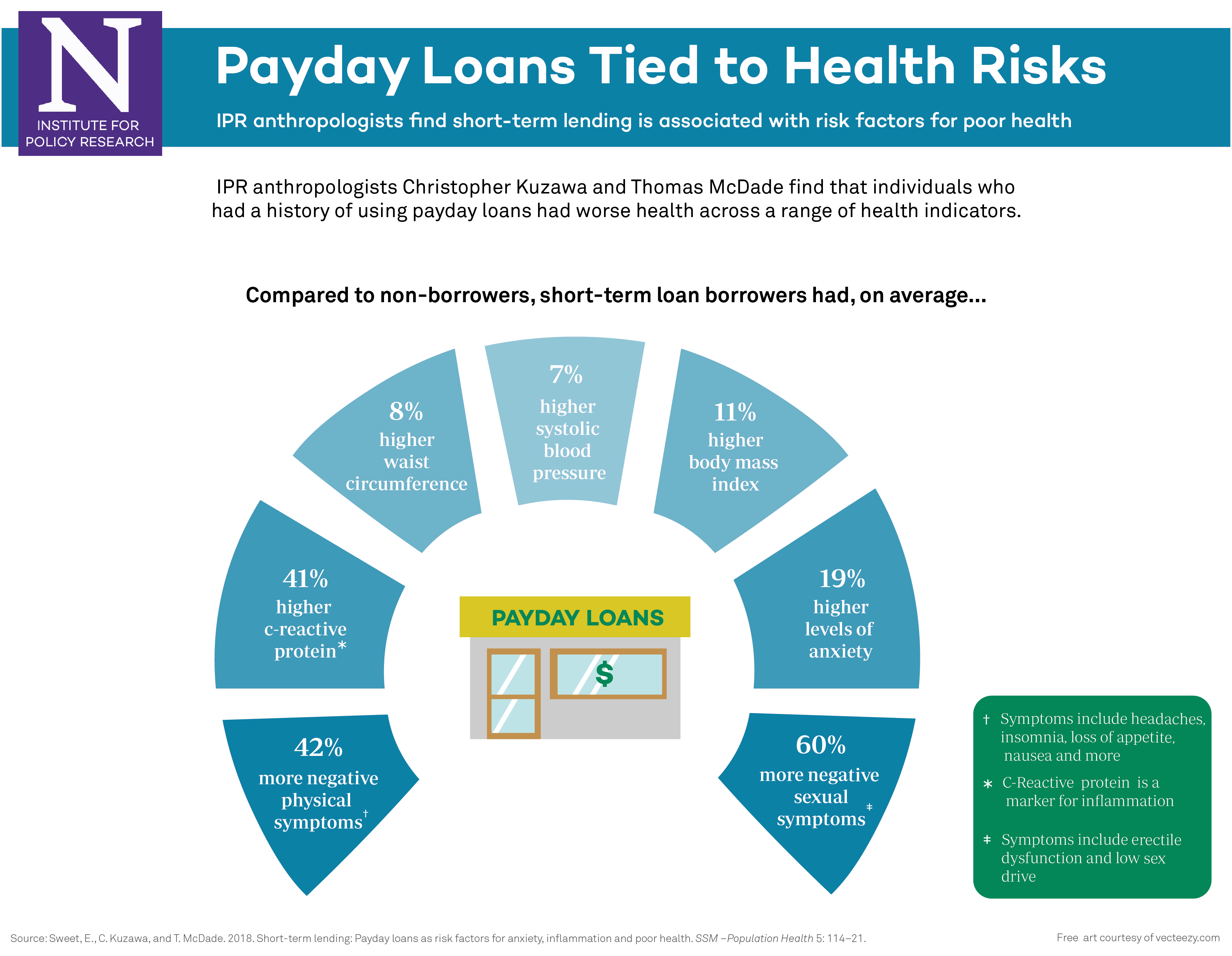

Infographic: Payday Loans Tied to Health Risks

IPR anthropologists find short-term lending is associated with risk factors for poor health

Get all our news

Given that predatory lending practices are more pervasive in low-income and minority communities, these types of unsecured loans may contribute to social disparities in diseases that are major public health burdens in the U.S.”

Thomas McDade

Carlos Montezuma Professor of Anthropology

About 12 million Americans use payday loans each year, but new research shows these short-term loans could be making borrowers sick.

In SSM - Population Health, IPR biological anthropologists Christopher Kuzawa and Thomas McDade outline how payday loans are associated with greater anxiety and more inflammation, which could be a sign of health problems.

Click on the image above to see a larger version of the infographic.

“We’ve known that these predatory institutions are exacerbating economic woes in high-risk communities,” Kuzawa said. “What this study shows is that the impacts of these practices go beyond the economic and can actually influence health.”

Kuzawa, McDade, and Elizabeth Sweet of the University of Massachusetts Boston find that among the 286 study participants, past and current borrowers had 42 percent higher C-reactive protein levels—a marker for inflammation that is associated with poor health. This puts them at “intermediate risk” of heart disease. In addition, borrowers reported more anxiety and symptoms such as loss of appetite, insomnia, and headaches.

Stress related to repaying a loan is likely contributing to borrowers’ health issues, the researchers note. The typical payday loan ends up being renewed several times, with the borrower owing, on average, $800 for a $300 loan.

Borrowers also had a 10 percent higher body mass index (BMI) and higher blood pressure than non-borrowers, although these outcomes might not be directly related to payday loans, but to the characteristics of people who typically rely on short-term loans.

People with a history of using payday loans were older, more likely to receive public assistance or welfare, and more likely to be African American or multiracial than those who had never used such services.

“Given that predatory lending practices are more pervasive in low-income and minority communities, these types of unsecured loans may contribute to social disparities in diseases that are major public health burdens in the U.S.,” McDade explained.

Christopher Kuzawa is professor of anthropology. Thomas McDade is the Carlos Montezuma Professor of Anthropology. Both are IPR fellows.

Published: September 18, 2018.