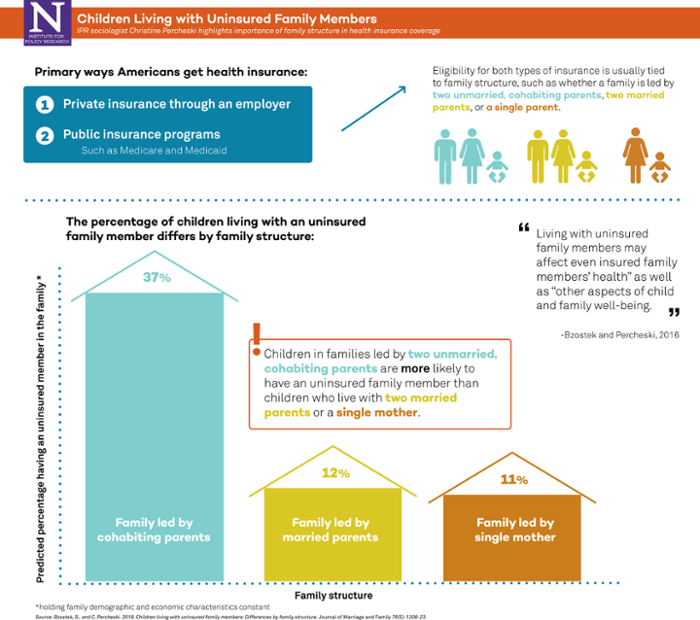

Infographic: Children Living with Uninsured Family Members

IPR sociologist highlights importance of family structure in health insurance coverage

Get all our news

Click on the image above to see a larger version of the infographic.

It is estimated that more than 50 percent of children in the United States will spend part of their childhood living in a family that is not headed by two married parents. While scholars have identified many ways in which “nontraditional” family structures contribute to inequality among children, the association between family structure and disparities in health insurance coverage has been less documented.

In recent research published in the Journal of Marriage and Family, IPR sociologist Christine Percheski and her co-author, Sharon Bzostek of Rutgers University, examine how health insurance coverage rates differ according to family structure. Specifically, they look at how likely it is that a child will have an uninsured family member based on family structure—such as whether the child’s family is led by two married parents, two unmarried parents, or a single parent.

Documenting the likelihood of having an uninsured family member is important, they explain, since “living with uninsured family members may affect even insured family members’ health” and impacts “other aspects of child and family well-being.”

Using 2009–11 data from more than 65,000 respondents to the National Health Interview Survey, the researchers find that children living with two unmarried, cohabiting parents are more likely to have an uninsured family member than those living with two married, biological parents or a single mother. This is in part due to the fact that health insurance eligibility rules are usually based on “traditional” family structures.

“Our results represent an important step in documenting the mismatch between insurance eligibility rules and increasingly complex family structures,” the researchers explain.

To address this “mismatch,” they suggest expanding eligibility—both for public insurance programs and employer-sponsored insurance—to include unmarried partners and their children. Doing so, they conclude, would reduce “uninsurance rates among adults and disparities in children’s rates of living with uninsured family members.”

Christine Percheski is assistant professor of sociology and an IPR fellow. The article, “Children Living with Uninsured Family Members: Differences by Family Structure,” can be found here.

Published: November 21, 2016.